Maui Real Estate COVID-19 Update

Posted by Alex Cortez on Friday, May 1st, 2020 at 5:18pm.

Updated November 15, 2020. Note: As an on-going service to our clients and site visitors, we will be updating this page weekly (on Sundays) in order to provide the most up-to-date, real-time market data on which informed decisions can be made. Last update: November 15, covering October and September. It was a long summer, it's finally cooling down.

First, our thoughts and prayers to all of those affected by the COVID-19 pandemic crisis and the significant social, economic, and geo-political effects that will arise from it. And to the first-responders and healthcare professionals on the front-line, our gratitude.

As the economic effects of the COVID-19 start being reflected in the real estate sector, it is vital to have real-time information. We are updating the charts below weekly and will annotate anything of particular interest for that week. Keeping in mind that there is a myriad of metrics to be used, to the point that they can be more confusing than helpful, we will primarily focus on three:

Closed Sales - Keep in mind that the 'sold' date is when the sale is recorded, but the escrow period can vary greatly in length based on the complexity of the deal, contingencies to be satisfied, financing, etc. In our market, that escrow can generally be in the range of 30 to 60 days, but there could very well be anomalies outside that range. Closed sales tell the story of what happened.

New Inventory - Over the past couple of years, one of the main storylines in the Maui real estate market is the 'lack of inventory'. With decreased supply, continuing demand then is reflected in an upward push on prices. However, the reverse also applies: an increase inventory coupled with prospective Buyers holding off can then result in a small pool of prospective Buyers, who then have more leverage on which to negotiate. New listings can also be a reflection of Seller motivation, as owners look for liquidity in what can be perceived as very uncertain economic times. New inventory tells the story of what could happen.

New Escrows - Closed sales in the upcoming months are based on the deals that are being negotiated now, with accepted offers opening new escrows. This is by far (arguably) the best metric to keep an eye on, as it reflects a meeting of the minds by willing Sellers and viable Buyers. New escrows tells the story of what will happen.

Although it's a bit speculative as to when COVID-19 started affecting our market conditions, from our perspective the Maui real estate market started showing a major shift in the second half of March. For context, data will include both year-to-date (YTD) and year-or-year (YOY) - the former to show how the market was doing and its reaction mid-March and the latter for comparison to how the market was acting in what was normal market conditions.

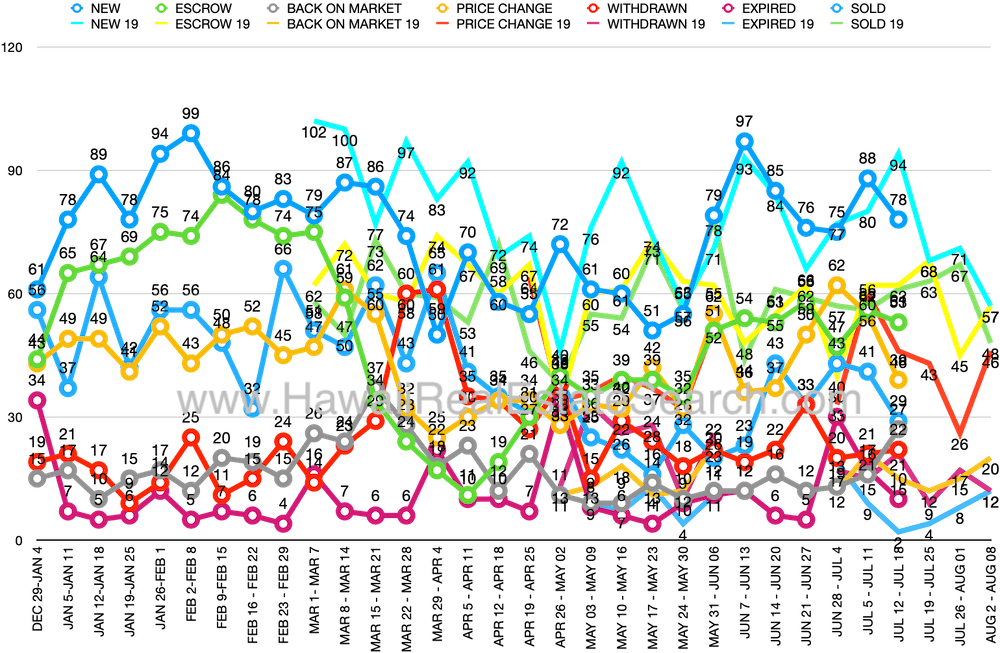

So let's start, review the chart below. This is an overall synopsis of the market, broken down by week to get a more real-time sense than monthly stats, and includes all pertinent statuses - new listings, sold, expired, withdrawn, price changes, new escrows, and back on market.

A few notes worth making:

* Follow the line of new escrows, which apexed in early to mid February, reflective of what was coming in as one of the most active years in Maui real estate history, and then see the sharp decline in starting on the second week of March and bottoming out in the second week of April. With most States under 'stay at home' orders and uncertainty as when most economies would start re-opening, along with the underlying long-term economic downturn, most prospective Buyers went into a 'wait and see' mode. Starting in late April, we are seeing a steady increase of new escrows, with numbers getting very close to 2019 levels.

* Starting in the beginning of March, the number of withdrawals (listings taken off the market) started increasing at rapid pace, with Sellers nervous about what how the market may react and whether absorption would most likely be under less than fair market value range. This pattern reached its peak the first week of April, after which it seems to be returning to pre-COVID-19 levels.

* Interestingly enough, the number of Price Changes has actually decreased, whereas the assumption was that Sellers would be adjusting in order to be more inline with Buyer's expectations. Heading into COVID, price changes decreased from typical levels and that stayed steady until the end of May, after which we are seeing more 'normal' levels but somewhat sporadic.

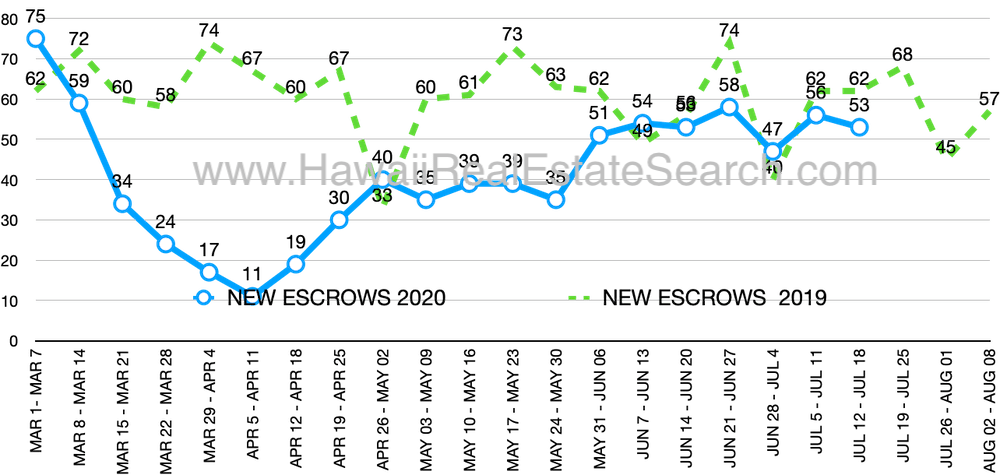

Now let's take a look at key metrics comparing year-over-year, starting with new escrows.

New Escrows

A couple of things that jump out. To start, number of new escrows is trending remarkably well since the bottom of the COVID-19 conditions, with weeks in May varying at 50-60% of last year's productions and we seem to be turning the corner with the past week at about 80% of last year's production for the week in question. That quick uptick is somewhat similar to market conditions in various parts of the mainland where pent-up demand is reflected in fast absorption. Coming into the end of June, we're seeing numbers almost at 2019 levels. The steady increase from late April to early June then had another jump and we're now getting closer to 2019 levels but not quite there yet.

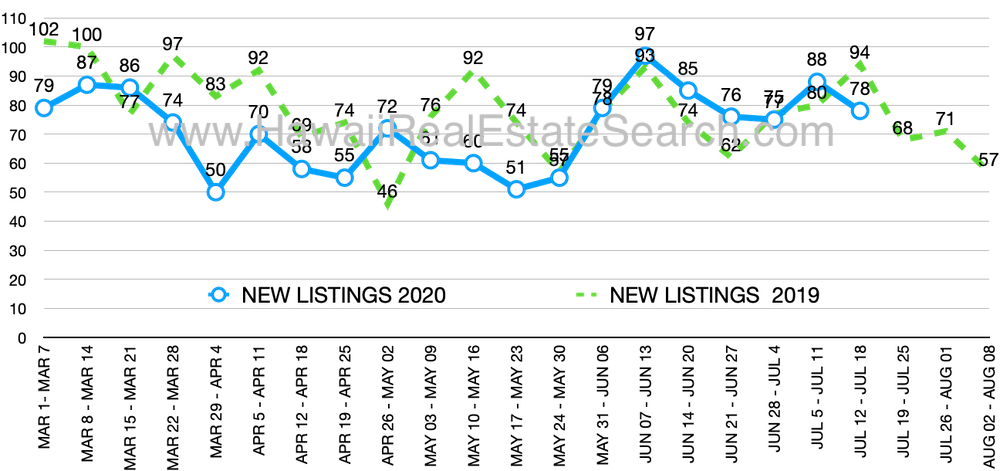

New Listings

New listings had been down and there seems to be the same seasonal adjustments as the previous year. This past week actually surpassed last year's new listings for that week. For the most part, new listings have been listed with asking prices consistent to recent (6-12 months) sales, except for a couple of units - values continue to be consistent without much devaluation. Contact us for details. Although the narrative among many pundits has been that there is a lack of inventory but as we can see, since the end of May, new inventory has surpassed the previous year. With travel restrictions extended through to the beginning of September (allegedly, still subject to change), we may start seeing a jump in inventory as the effects in the local economy are elongated.

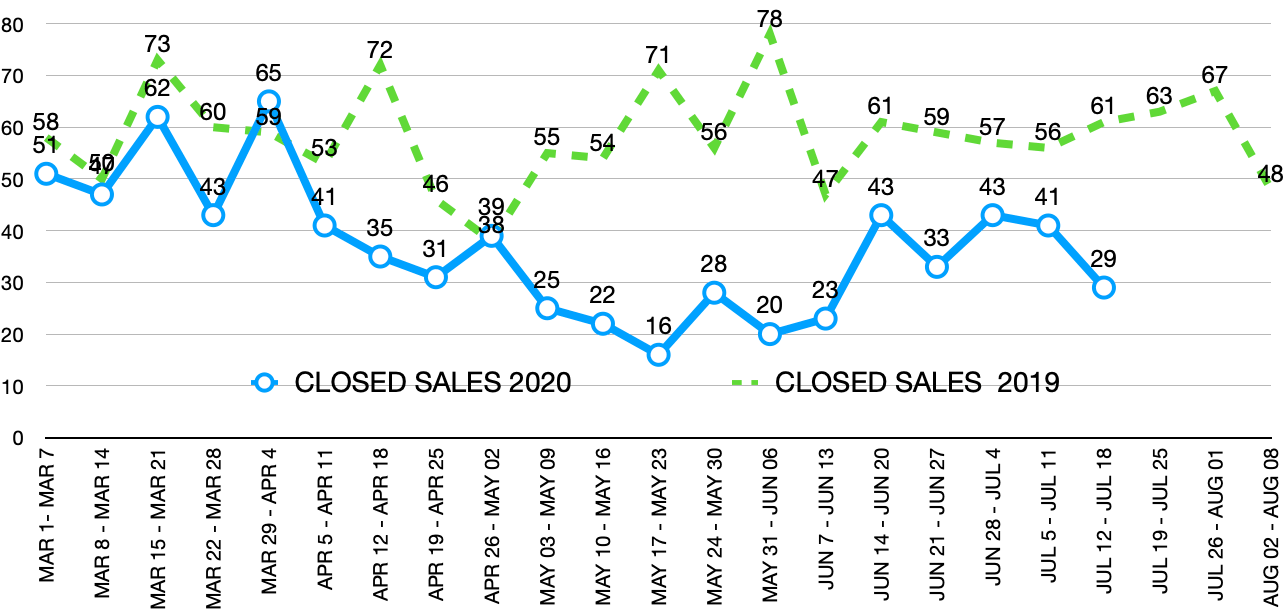

Recorded Sales

Again, keep in mind that a good number of recorded sales were deals negotiated prior to COVID-19 being at the forefront of people's mind. The big drop in escrows in mid April are was then reflected in the drop in recorded in late May. Through June, sales were up a tad higher than 40 per week - still not at 2019 levels, but it's a step in the right direction.

Week of Jul 12 to July 18 - A few noteworthy sales, including the combined townhome in Wailea Ekahi (units 15B&C), and a Mana Kai listing - it's worth saying that both of these were in escrow PRIOR to COVID-19 affecting the market. New inventory continues to come on the market at a good pace and there are a couple of particularly strong values. As of this posting on July 19, recorded sales are much lower than previous weeks, but it's possible that some more will be reported in the next few days with a closing date prior to July 18.

Week of July 5 to July 11 - A couple of pretty strong sales recorded, including Makena Surf A-101 and Kaanapali Alii 1-1003; of particular interest as both of these are short-term rentals and this has been a sector that has been quite impacted by Buyers going into a 'wait and see' holding pattern while the travel restrictions hold. Quite a few of the single-family homes that closed were in escrow well before COVID-19 became a factor. On the listing side, a handful of new listings in Launiupoko seem to be garnering attention by affluent Buyers looking for privacy.

Week of Jun 21 to June 27 - For the most part, sales that have closed have been consistent with values of pre-COVID sales, with no dip in values. However, there have been a few sales at a particular West Maui property that have been arguably below market value - contact us for details. Amount of new listings actually surpassed same time period in the previous year. With Sellers now having a better sense of the new 'normal' with the uncertainty of the initial COVID-19 shock now in the rearview mirror, we are seeing an influx of new Inventory. News of Hawaii reopening back to tourism on August 1 has been met with much enthusiasm from locals who are eager to welcome back visitors and the tremendous effect they have on our economy.

Week of Jun 14 to Jun 20 - For us here locally, news that the 14-day quarantine provision (which effectively stops tourism from the mainland and international) is extended through the end of July was a bit of a punch to the gut. There must be a balance between the safety of our residents and the push to reopen the economy, we acknowledge that. We are just eager to welcome visitors again. However, as of June 16, inter-island travel is now allowed. On a more direct real estate front, the number of closed sales this week was very encouraging, with over 40 properties closing, nearly double the amount of the previous week.

Week of May 31 to June 6 - Recorded sales will be a mere shadow of last year's production based on the big drop in escrows in early to mid April. Prices continue to hold steady, while price adjustments are finally happening to a more 'normal' level. New listings are finally getting to pre-COVID levels with the past week actually surpassing last year's new inventory. A couple of listings have come on the market below what could be deemed as fair market value, perhaps reflective of Sellers who are looking to liquidate assets. Contact us for specifics.

Week of May 17 to May 23 - Here we are starting to see the drop in escrows in the early to mid April time period being reflected in huge reduction of closed sales, with the expectation that the market will scrape along at the bottom for the next couple of weeks. We are still not seeing a drop in values and the expectation is that with decreased inventory, there is less options for Buyers hence affecting supply/demand, even while absorption remains low. New escrows over the past couple of weeks have been steady, but at roughly 50-60% the absorption over the previous year. For new inventory, no market-wide decrease in values, although a couple of listings have come on the market below the fair market value range established by recent comparable sales.

Week of May 3 to May 9 - New Listings continue to be slightly below what they were a year ago and so far, for the most part, listing prices are consistent with pre-COVID-19 pricing, with very few exceptions. The introduction to the MLS of Wailea Hills first phase La'i Loa is also noteworthy, as typically we don't see many of these new developer offerings being listed on the MLS. However, the bigger story is the level of new escrows still at about half of what it is on a more typical year - there IS consumer confidence up to an extent but many prospective Buyers remain on the sideline waiting for the dust to settle, thereby creating the void between current absorption and what is generally expected. Take a look at the closed sales in the past weeks, trending downwards at a more pronounced pace over the last few weeks. Expect this trend to continue as the bottom of new escrows starts being reflected in closed sales. It can be speculated that we'll have a week or two where there mark is 10 closed sales in a week period, based on the April 5-April 11 week of new escrows. Still too early to tell whether values will be significantly affected and, if so, the extent of such impact.

Week of Apr 26 to May 2 - The big story for the week, however, is the increase in escrows which is a tremendous indication specially when considering that number surpasses same week a year ago. The average list price of these new escrows is $585K while the median is at $792K. Also, the fact that there were more single-family residences (22) than condos (17) is significant - with SFR's generally being more owner-occupant properties, it shows that sales of primary residences continues strongly. Sales of Luana Garden Villas continue and may skew statistics as these were deals brokered a while ago (some going back two years), however, with a Montage and a Wailea Beach Villas also selling at sales prices consistent to other recent sales, that's indicative of consumer confidence in the high-end sector. For new listings, this week is somewhat inflated by one agent changing companies and re-listing 13 listings with the new brokerage. Even so, higher total than a year ago.

April Overview - April was the month of uncertainty, with prospective Buyers holding off not knowing how the market would react. This hesitation was evident in the number of escrow. Comparing April 2019's 279 escrows (average $817,050, median $650K) to April 2020's 94 escrows (average $816,500, median $340K), the decrease was 66%. The number of sold units was not too far off, with April 2019 recording 240 (average $859K, median $558K) compared to this year's April closing 204 (average $889K, median $675K). So far, we have NOT seen a consistent drop in values that many pundits and prospective Buyers have been expecting. Keeping in mind that Maui owners are generally equity-rich (over the past decades, roughly half of purchases have been cash), the expectation of a flood of distressed (short-sales and REO's) is premature.

Of course, the metrics above speak to market activity but not to fair market value or trends/projections of value, which are best measured in a granular level. To discuss in much greater detail any market (i.e. vacation rental condos in Wailea, Wailuku single-family homes), contact us.

RESOURCES:

Maui Real Estate Statistics: April 2020

Maui Real Estate Statistics: June 2020

Presentation by one of Hawaii's most respected economists:

June 18, 2020

May 5, 2020

Specializing in Makena and Wailea real estate, Alex Cortez is fully dedicated to representing his clients ethically and diligently. Contact him at 808.385.5034 or Alex@MauiRealEstateSearch.com for more information.