Hawaii 1031 Exchanges

1031 Exchanges - Growing Wealth Smartly...

Usually, when an investor sells an investment property for a greater value that what was paid for it originally, any profit from the sale is subject to capital-gains tax. Time to speak to a tax advisor and/or financial planner.

Thinking of conducting a 1031 Exchange in Hawaii? Contact Us Today

But thanks to IRS' Section 1031 of the tax code, an investor can sell their old investment property (relinquished property) and use all of the equity to purchase a new investment property (replacement property) — all while deferring the capital-gains taxes that would usually be applied to the sale. Known as a 1031 Exchange or 1031 Tax-Deferred Exchange, this type of transaction allows an investor to reinvest the proceeds from the sale without having to pay additional taxes - which can be quite substantial. In addition to which, typical withholdings, such as HARPTA (7.25% of amount realized) and FIRPTA (generally 15% of amount realized) are not applicable when conducting a qualified 1031 Exchange.

Undoubtedly, this makes Section 1031 one of the greatest wealth building tools in the tax code. But it’s also one of the most under-utilized.

Search all Hawaii Real Estate Properties for options that suit your needs in terms of price, size, location, etc. Remember, on the buying side / replacement side, the Sellers must agree to being a part of the 1031 Exchange at no liability or cost to them. Have you found an option to purchase or thinking of selling your current Hawaii Property to participate in a 1031 Exchange? Contact Us.

Four Ways to Conduct a 1031 Exchange

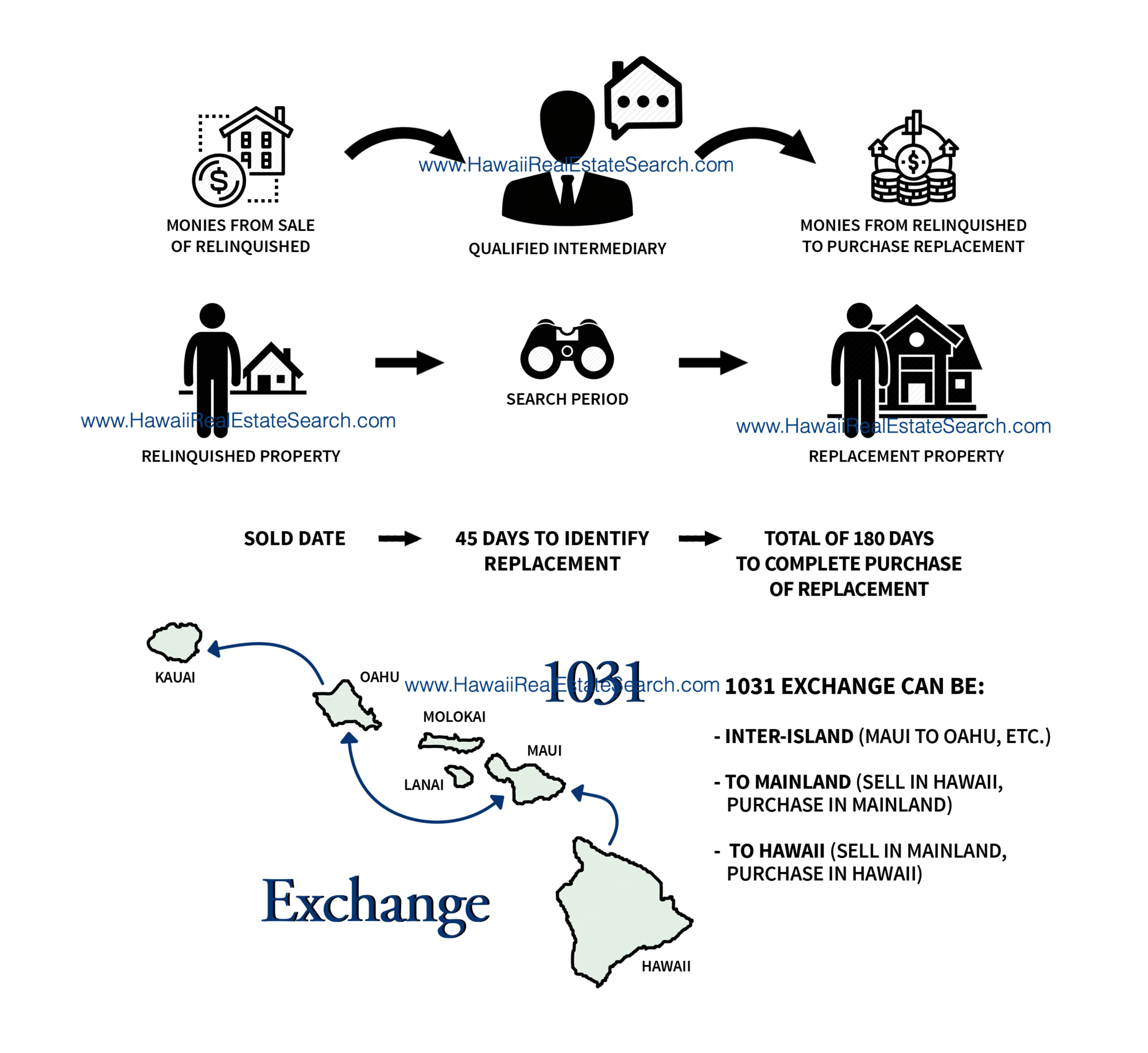

A Delayed Exchange - The most common way to complete a 1031 Exchange, under this method, the Exchanger obtains a Qualified Intermediary (QI) to prepare an exchange agreement for the sale of a relinquished property. From the time that the relinquished property closes, the Exchanger has a 45 day window within which to identify the replacement property. There are applicable identification rules to keep in mind:200 % Rule - Identify any number of properties, the sum of the value for which must not exceed 200% of the fair market value of the relinquished property.

3 Properties Rule - Identify 3 properties, the total value being irrespective.

95 % Rule - Identify any number of properties, regardless of value, so long as 95% of the identified properties is to be acquired as the replacement property/properties.

Upon closing of the relinquished property, the Exchanger has a total of 180 calendar days or the exchanger's tax filing date (whichever is earlier) to acquire the replacement property. It is important to note which is the earlier of the dates, as closing on a relinquished property in December will net the Exchanger less than 180 days, unless an extension is filed (must consult with your tax advisor).

Reverse Exchange - A reversed exchange happens when the replacement property is acquired first. The QI enlists the assistance from a Exchange Accommodation Titleholder (EAT) to purchase the property using a loan from the Exchanger. The EAT will enter into management agreement with the Exchanger, to allow the latter management access to the replacement property during the 'parking' period. The timelines then work in reverse: from the time the replacement is acquired, the Exchanger has 45 days to identify which property he/she wants to relinquished and then has a total of 180 calendar days to complete the sale of the relinquished property. The caveat with the Reversed 1031 Exchange is that the Exchanger must loan the funds to acquire the replacement property before the relinquished property is sold AND when selling the relinquished property, there will be the added pressure that the sale must close within the allocated timeframe without exception.

Simultaneous Exchange - This happens when both the relinquished and the replacement property close at the same time. It's imperative to still use the services of a QI in order to maintain safe harbor and avoid constructive receipt of funds.

Improvement Exchange - This can happen in the context of either a delayed exchange or reverse exchange when an Exchanger wants to use proceeds from a relinquished property to make improvements on the replacement property. However, it's worth noting that these improvements do NOT qualify if the property is already owned by the Exchanger, also note that the proceeds cannot be used to pre-pay for improvements to be made after closing. For a deeper discussion of whether this can be a viable option, contact us.

1031 Exchange Requirements

Like-Kind Property - In order to qualify for a 1031 Exchange, an investor must purchase “like-kind” property with the gains from the old investment property. The term 'like kind' can be misunderstood to mean 'a condo for a condo' or 'commercial building for commercial building', but that is erroneous. 'Like kind' can be interpreted as the sale/purchase of an investment property across several categories, such as office building, single family rental, law land, duplex, motel, apartment buildings or condos therein, even the rights to a 30 year lease. In general, this definition is pretty broad and it is best to speak to a reputable 1031 Exchange Qualified Intermediary for clarification.

Timelines - All exchanges are subject to strict timelines. For example, the investor has 45 days to identify a “like-kind” property of equal or greater value after closing the sale of the relinquished property. Then the investor has 180 days from the date of the original sale to close on the purchase of the new investment property.

Intermediary -

There are multiple terms used, to include Facilitator, Accommodator, but as per Treasury Regulations, the term is 'Qualified Intermediary' - this is the party that facilitates the exchange for the Exchanger, as monies from the relinquished property cannot go directly to the Exchanger.

There are multiple terms used, to include Facilitator, Accommodator, but as per Treasury Regulations, the term is 'Qualified Intermediary' - this is the party that facilitates the exchange for the Exchanger, as monies from the relinquished property cannot go directly to the Exchanger.Investment - Both properties must be investments. For example, one cannot sell a primary home and purchase an investment property, or vice versa. To learn more about IRC 121 and how that may be applicable for the purchase of a personal-use property, contact us.

Equal or Greater Value: Investors must exchange properties with those of equal or greater value. For example, if an investor sells a property for $1.5 million, he or she must purchase at least $1.5 million in property. That property, however, can come in the form of multiple properties or a single one. If the purchase is for a property of lesser value than the relinquished property, that creates a 'boot', which will be a taxable portion of the monies realized. It's not uncommon for an investor to want to roll some of the value of the relinquished property into a replacement while keeping some cash - so long as tax implications are understood beforehand to avoid surprises.

Questions commonly asked:

Can I sell my primary residence and roll the monies into a 1031 Exchange? Or can I use the monies from my relinquished investment property and buy a personal residence or vacation home? Short answer: Speak to our preferred 1031 Exchange vendor who can explain applicable rules regarding IRC 121 Primary Residence Exclusion and safe harbor rules.So when is it the right time to buy an investment property? The short answer, it is dependent on the specific goals and timeframe for an individual investor. A 1031 Exchange allows the investment to grow, all while the bulk taxation is deferred. Because there is no limit on how many times an investor can roll over gains from one investment to the next, one is able to profit on each swap and only required to pay tax when property is relinquished without replacement.

Can I sell my investment property and add my wife on the new property? It's imperative to note that the taxpayer who exchanges the relinquished property is the same taxpayer who takes title of the replacement property.

There are some exceptions to this 'same vesting' rule, contact a reputable QI for more details on that.

While I'm waiting to buy the replacement property, do I get the money from the relinquished property? The short answer is a hard no. It is imperative that the Exchanger does NOT get constructive receipt of monies. If the Exchanger fails to identify the property within the 45 days or fails to complete the exchange within the 180 days, then he/she will have positive possession of said monies.

Conclusion

The Hawaii real estate market presents a plethora of opportunities to take advantage of 1031 Exchanges, to include short-term rental condos, commercial properties, even raw land. Our team of agents have pertinent experience in assisting investors Statewide, whether buying a Wailea condo, a vacation rental in Princeville, a Kona home, or a Kakaako luxury condo, we have a qualified expert to assist. And our network of 1031 Exchange Intermediaries will make the process as seamless as possible.Please keep in mind that this information is for illustrative purposes only, not deemed to be legal or financial advice. Please consult with an attorney, 1031 Exchange Facilitator, tax advisor, financial planner, or an otherwise qualified professional with in-depth knowledge in the matter to better discuss your needs.

Contact Us

Our team members have decades of combined experience in assisting clients in both the sale and purchase of properties in Hawaii via a 1031 Exchange throughout the entire State. Let our experience be your advantage. We have established relationships with very reputable 1031 Exchange Qualified Intermediaries with experience in executing exchanges in Hawaii and who are ready to be of help.