Maui Property Tax Update 2018 to 2019

Posted by Alex Cortez on Monday, June 4th, 2018 at 4:46pm.

Update: For the latest Maui Property Tax Rates and to compare to other Counties in Hawaii, visit our Hawaii Real Estate Tax Rates page.

In an effort to keep our clients updated on Maui County property tax rates, we are posting the new tax rates for the fiscal year which runs from July 1, 2018 through June 30, 2019. For the most part, tax rates are very slightly adjusted to the previous year but it is absolutely worth noting that there is a new category: Short Term Rental.

Rates are as follows, based on $1K of assessed value:

Single Family Residence: $2.86 (Homeowner) and $5.52 (Second Home)

Agricultural: $6.00

Hotel/Resort: $9.37

Apartment: $6.31

Short-Term Rental: $9.28

Commercial Residential (see note below): $4.55

Conservation: $6.35

Industrial: $7.45

Commercial: $7.25

Time Share: $15.41

A couple of notes:

* Condos are put into a category based on their actual use (i.e. Homeowner vs. Apartment vs. Hotel/Resort).

* Homes that have a permit to operate as a Transient Vacation Rental (TVR, short-term rental, vacation rental) or as a Bed and Breakfast fall into the category of Commercialized Residential.

* For owner-occupants, Maui continues to offer one of the lowest property tax rates in the nation.

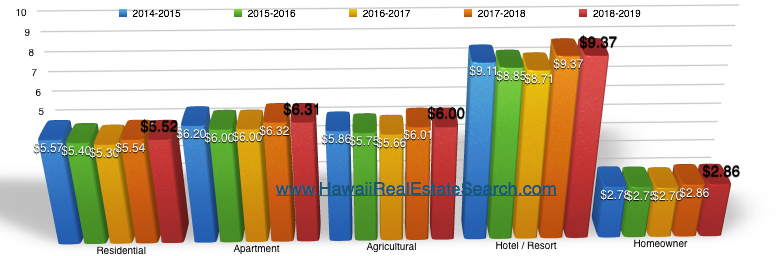

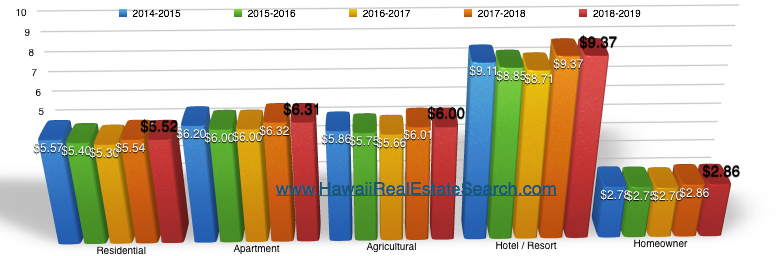

How do these rates compared to the previous years? Take a look at the chart below, detailing rates over the past 5 years. Frankly, these seem to be remarkably stable, particularly so over the past two years.

For those interested in learning more about the Maui real estate market and how property taxes may affect a purchase, contact us.

In an effort to keep our clients updated on Maui County property tax rates, we are posting the new tax rates for the fiscal year which runs from July 1, 2018 through June 30, 2019. For the most part, tax rates are very slightly adjusted to the previous year but it is absolutely worth noting that there is a new category: Short Term Rental.

Rates are as follows, based on $1K of assessed value:

Single Family Residence: $2.86 (Homeowner) and $5.52 (Second Home)

Agricultural: $6.00

Hotel/Resort: $9.37

Apartment: $6.31

Short-Term Rental: $9.28

Commercial Residential (see note below): $4.55

Conservation: $6.35

Industrial: $7.45

Commercial: $7.25

Time Share: $15.41

A couple of notes:

* Condos are put into a category based on their actual use (i.e. Homeowner vs. Apartment vs. Hotel/Resort).

* Homes that have a permit to operate as a Transient Vacation Rental (TVR, short-term rental, vacation rental) or as a Bed and Breakfast fall into the category of Commercialized Residential.

* For owner-occupants, Maui continues to offer one of the lowest property tax rates in the nation.

How do these rates compared to the previous years? Take a look at the chart below, detailing rates over the past 5 years. Frankly, these seem to be remarkably stable, particularly so over the past two years.

For those interested in learning more about the Maui real estate market and how property taxes may affect a purchase, contact us.

Specializing in Makena and Wailea real estate, Alex Cortez is fully dedicated to representing his clients ethically and diligently. Contact him at 808.385.5034 or Alex@MauiRealEstateSearch.com for more information.