Maui Property Tax Update 2017 to 2018

Posted by Alex Cortez on Tuesday, June 20th, 2017 at 11:50am.

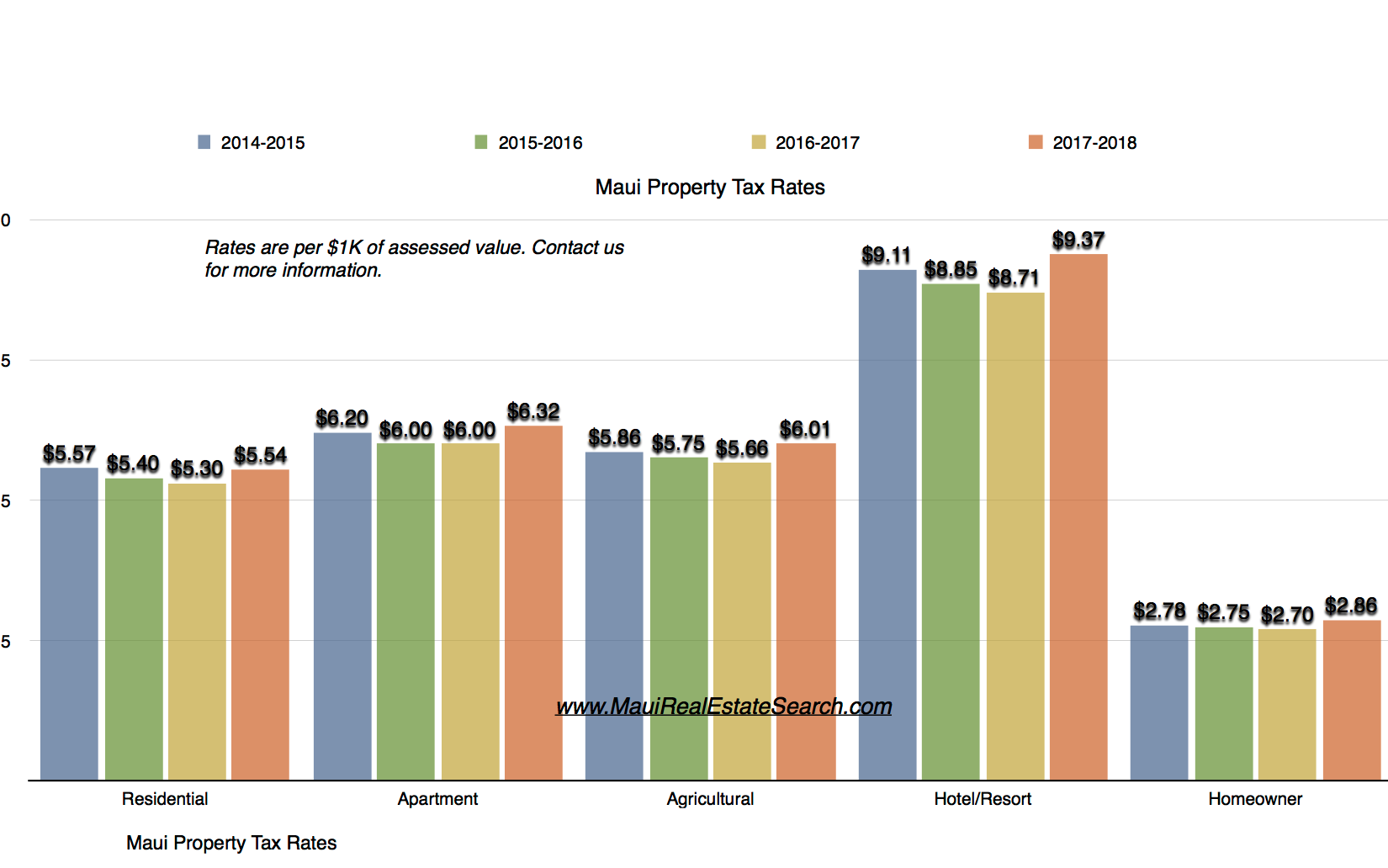

One of the first questions that a prospective purchaser of Maui real estate must ask is: what are the property tax rates? As many readers of this blog and our clients know, Maui enjoys some of the lowest tax rates in the US, particularly for homeowners. Now that the new tax rates have been made public for the 2017-2018 fiscal year, we are posting them below. For the same of comparison and context, the chart below details the tax rates for the previous years as well:

As noted, tax rates were reduced slightly from 2015-2016 going into 2016-2017, yet increased for the current 2017-2018 year. Properties are classified based upon the highest and best use and those which have an approved homeowner exemption are classified as Homeowner. Condominiums are classified based on their actual use: Apartment, Commercial, Hotel / Resort, Timeshare, Homeowner.

Below are pertinent dates to remember, as established by the pertinent Maui County governing bodies.

| Date | Event |

| July 1 | Tax year commences. Taxes are calculated based upon January 1 assessed values and fiscal year tax rates. |

| July 20 | First half of fiscal year tax bills mailed. |

| August 20 | First half of fiscal year tax payments due. |

| September 1 | Deadline for filing dedication petitions. |

| December 1 | Condominium AOAO use declaration. |

| December 31 | Deadline for filing circuit breaker applications for the next fiscal year. |

| December 31 | Deadline for filing exemption claims and ownership documents. |

| January 1 | Assessed values established for use during the next tax year. |

| January 20 | Second half of fiscal year tax bills mailed. |

| February 20 | Second half of fiscal year tax bills due. |

| March 15 | Assessment notices mailed. |

| April 9 | Deadline for filing appeals. |

| May 1 | Certified assessments forwarded to the County Council for budget purposes. |

| June 20 | Tax rates established by the County Council. |

For those interested in exploring the Maui real estate and how property tax rates affect purchasing power, contact us by filling out the form below or call 808.385.5034 or 808.392.6657

Specializing in Makena and Wailea real estate, Alex Cortez is fully dedicated to representing his clients ethically and diligently. Contact him at 808.385.5034 or Alex@MauiRealEstateSearch.com for more information.