Honua Kai Mid Year Review 2015

Posted by Alex Cortez on Sunday, June 28th, 2015 at 4:07pm.

As 2015 comes to a mid-point, our visitors and clients continue to request (and rightfully deserve) the most updated information on the Honua Kai real estate market. So let's start by recapping activity on the month of June, in lieu of our typical monthly report.

June 2015

June proved to be a slow month statistically, but one that could result in significant activity down the line. Only one sale recorded, the sale of Konea 110 for $825K. This unit is perfect example of the direction of values for 1 bedroom units. A large (730 sq. ft.) floor plan with a spacious lanai facing the resort area between the two towers. At $825K, the price per square foot of $1,130 is consistent with fair market value for specialty 1 bedroom units. There was only one new listing coming on the market - and one that arguably will not last on the market long. Hokulani 333 is listed for sale at $810K - although it may seem on the high side for Studio units, the lack of viable inventory in this niche will result in pent-up demand absorbing this unit. As we had discussed in our Honua Kai Investment Analysis, the Studio units are strong return-on-investment performers based on high rental demand and low (comparably) cost of ownership. For information about its current rental history and projected income, contact us. What proved to be interesting in June are the three units went under contract: Hokulani 412 (a great value at its listed price of $1.1M), Konea 345, and Hokulani 1037 - all of which are premium units, ranging from $1.1M to almost $2.9M. Their absorption will continue moving the Honua Kai market the rest of the yea in the right direction.

Honua Kai 2015 Mid Year Review

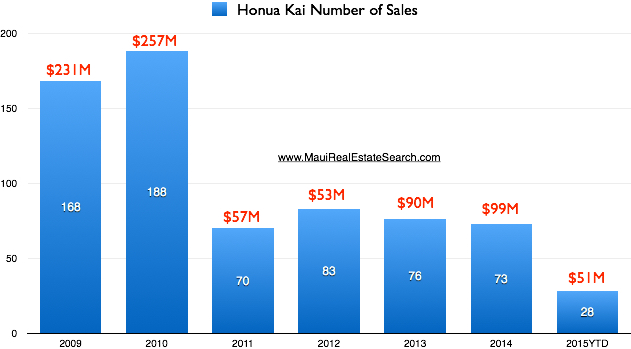

There are a number of metrics that point to a market that is stable in its absorption and in which demand with limited supply are resulting in increasing values. First, let's take a look at the number of units sold, with the context of previous years:

Although the number of sales is down in comparing year over year sales - 46 sales in the first half of 2014 versus 29 year to date in 2015 - the total sales volume is pointing to a market in which more smaller sales are being replaced with fewer bigger sales. It's also interesting to note that the subject sales in 2014 were mostly cash (63%) whereas 2015 has shifted significantly to more financed sales, with 'only' 38% by way of cash sales.

Average & Median

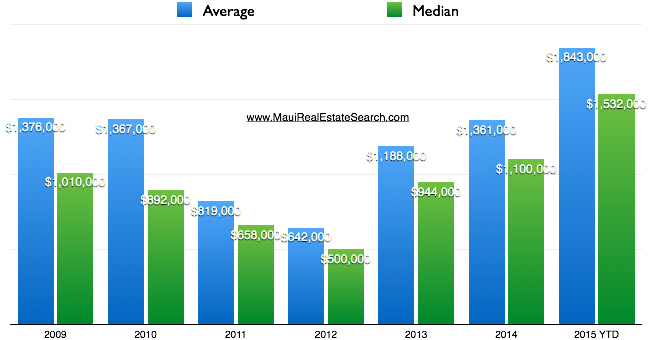

Now let's take a look at Median and Average sales prices:

It becomes evidently clear that 2015 YTD average and median prices are by far the highest they have ever been at Honua Kai - an average of $1.843M and median of $1.532M are impressive in ANY market, specially given the amount of sales which prove consistency.

Average Price Per Square Foot

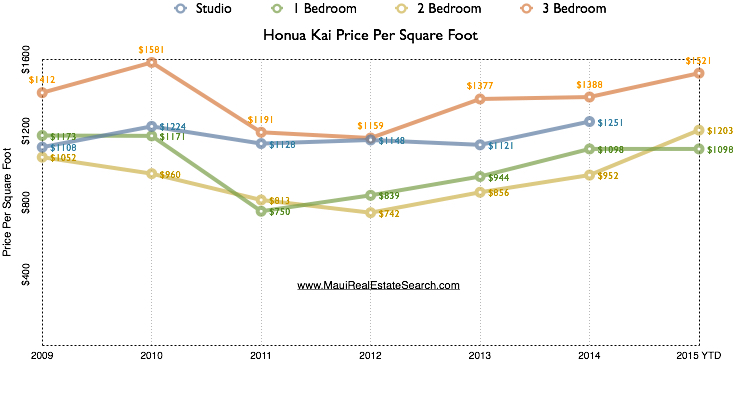

A key indicator when measuring fair market value is the price per square foot, in order to best gauge an apples to apples comparison. So with that, let's take a look at the the price per sq. ft. over the previous years, broken down by unit size/type:

An interesting note is that the price per sq. ft. of the 2 bedroom units has sky rocketed - for more insight as to WHY that has happened and how that is affecting the Honua Kai micro-market, contact us.

Size of Units Sold

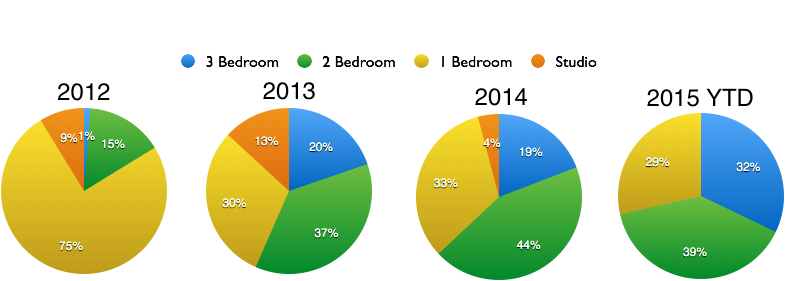

What kind of units are selling? view the chart below, which breaks down the number of sales by unit size in the context of previous years:

This helps to explain the higher average and median sales prices, as it is the larger size units that are the bulk of the sales thus far this year. No studios sold and the percentage of 1 bedroom units decreased.

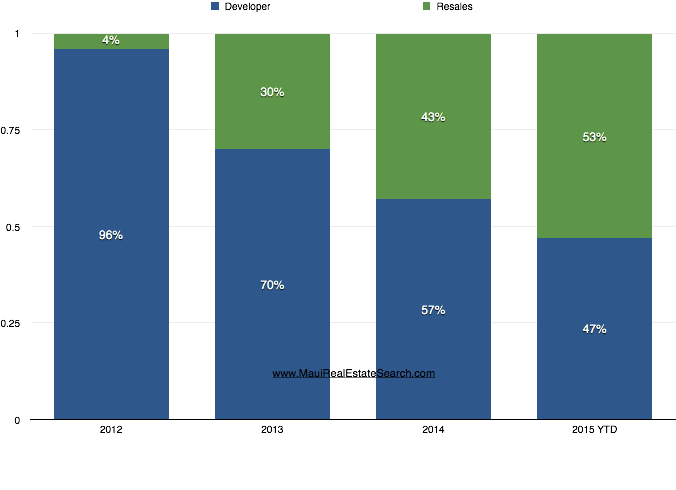

Developer vs. Resales

The underlying story at Honua Kai is the role of the developer inventory as we near the end of available developer sales. Take a look at the graph below:

Over the past 2 and a half years, there has been a significant shift in the type of sales, from a primarily developer-driven market to one in which resales have picked up the slack and are now the dominant sector of the market being sold. Presumably, within the near future the developer sales will be absorbed and the resales market will set fair market values based on demand and supply.

Conclusion

We are often asked 'when is the right time to buy at Honua Kai' and the answer has consistently been that all other things being equal, then the sooner the better. Values continue to climb, sustainably so, and potential purchasers continue to be priced out of the market. The eventual end of developer sales will, arguably, result in values going up with sellers (particularly of under-represented units) will feel more confident in pushing prices upwards.

For those considering the sale or purchase of a Honua Kai condo for sale, we humbly request your consideration. We are extremely well-acquainted with micro-market conditions and diligently represent our clients as strong advocates throughout the process - our expertise is reflected in representation through multiple transactions and a large database of Honua Kai clientele. Call 808-385-5034, email Alex@MauiRealEstateSearch.com or fill out the form below.

Specializing in Makena and Wailea real estate, Alex Cortez is fully dedicated to representing his clients ethically and diligently. Contact him at 808.385.5034 or Alex@MauiRealEstateSearch.com for more information.