Honua Kai 3rd Quarter 2015 Market Report

Posted by Alex Cortez on Saturday, October 24th, 2015 at 3:09pm.

The 2015 year is going by in a flash and although we do monthly reports of the Honua Kai micro-market, it is important to have a broader overview of the market as it evolves. First, let's examine what happened in the 3rd quarter of 2015.

New Listings 3Q15

The Honua Kai micro-market introduced 19 new listings during the subject time period. The new inventory is broken down as follows: 1 Studio (sold before listed, for comps purposes only), 4 one bedroom units, 9 two bedroom units, and 5 three bedroom residences. The influx of over $31M in listings is welcomed as supply has been comparatively low, but the need for more one bedroom units becomes more apparent - particularly well-priced units with ocean view corridors.

Sold Listings 3Q15

Nine sales closed in the 3rd Quarter, making it the quarter with the lowest absorption at Honua Kai - more on that below. The breakdown is as follows: 1 Studio (sold before listed), 7 two bedroom units, and a phenomenal three bedroom residence. It's worth noting that there were no sales of one bedroom units - arguably due to the lack well-priced inventory at the time, although that has been aided by some outstanding values coming in the market recently, such as Hokulani 240.

Honua Kai Overview Analysis

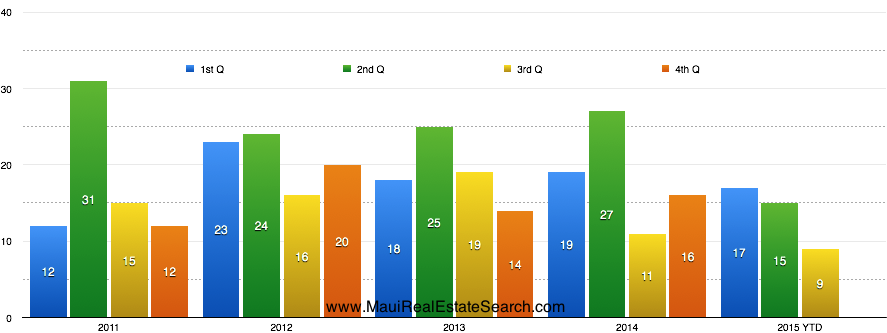

As noted above, the nine sales recorded in the 3rd quarter of 2015 represent the lowest total of units sold in any previous quarter. Let's take a look below at the number of sales per quarter since 2011 - purposefully leaving out 2010 as that is when the bulk of developer sales occurred.

As can be easily ascertained, the 2nd quarter has typically been the one in which the most units have sold; which is logical due to the seasonality of our market - high season (late December to early April) sales coming to fruition late in the first quarter and spilling into the 2nd quarter. The latter part of the year flip flops in activity between the 3rd and 4th quarters, although expectation for the remainder of the 4th quarter of this year is high. So far there has only been 1 sale recorded in October, but with 5 in escrow and other strong value propositions becoming available (such as Hokulani 710), we expect a strong end to the year particularly if the influx of Thanksgiving buyers close prior to the end of year.

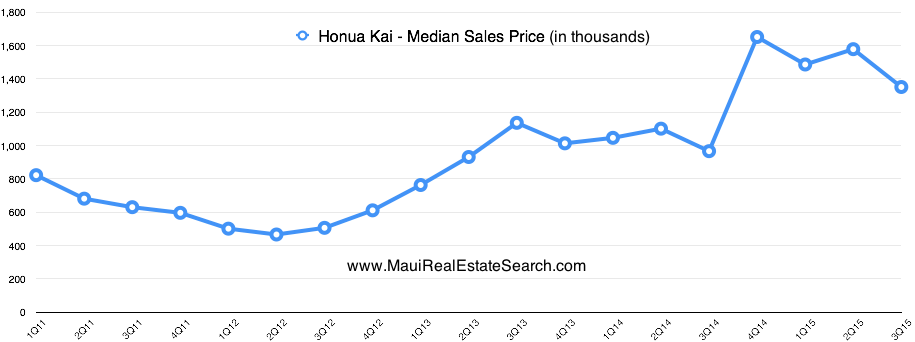

However, the amount of sales is not the only metric to consider, the median sales price gives a gauge as to how value is increasing (if at all) and the type/size of unit being absorbed. So with that, let's examine the chart below which reflects the median sales price per quarter for the same period as the chart above - from 2011 to the present.

As evidenced above, the end of 2012 was the turning point where values started climbing upwards. Late 2012 saw the beginning of values stabilizing with a very gradual upwards trends; from mid 2013 to late 2014, the median sales price hovered in the $1-1.2M range and the last quarter of 2014 reflects a significant leap upwards with the median sales in the mid $1M's. This is not necessarily reflective of an explosion in values, but rather absorption of larger units with an emphasis on premium 2 bedroom units (upper floors, inner courtyard). As of the writing of this post on October 24th, of the 39 sales in 2015 fourteen were cash purchases (35%), seven were 1031 Exchanges (17%), and the remainder were conventional financed purchases. As a comparison, of all Honua Kai sales in 2014, cash sales accounted for 55% of the sales, 1031's were only 4%, and the remainder were conventional sales.

As evidenced above, the end of 2012 was the turning point where values started climbing upwards. Late 2012 saw the beginning of values stabilizing with a very gradual upwards trends; from mid 2013 to late 2014, the median sales price hovered in the $1-1.2M range and the last quarter of 2014 reflects a significant leap upwards with the median sales in the mid $1M's. This is not necessarily reflective of an explosion in values, but rather absorption of larger units with an emphasis on premium 2 bedroom units (upper floors, inner courtyard). As of the writing of this post on October 24th, of the 39 sales in 2015 fourteen were cash purchases (35%), seven were 1031 Exchanges (17%), and the remainder were conventional financed purchases. As a comparison, of all Honua Kai sales in 2014, cash sales accounted for 55% of the sales, 1031's were only 4%, and the remainder were conventional sales.

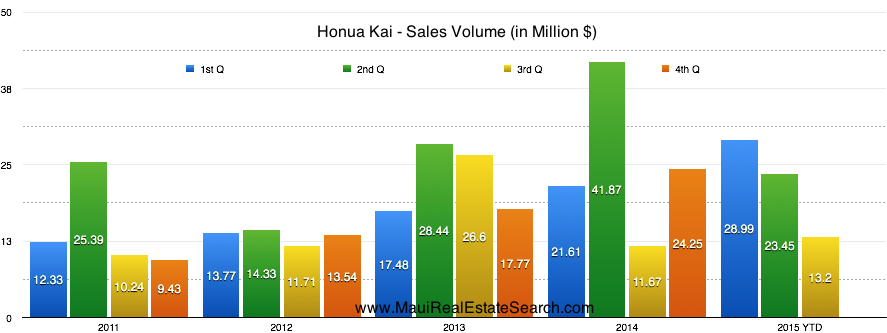

In a market with various niches (i.e. 3 bedroom villas, inner courtyard 2 bedroom units, etc.) another metric that can be telling of discernible trends is sales volume by dollar amount. Let's take a look at the following chart:

A key takeaway from looking at the above is that although the 3rd quarter of our current year had the lowest amount of sales in the subject period, it had the second highest sales volume of any of the 3rd quarters. And although there are 5 pending sales, the total from those units will be in the range of $10M and the market will need a significant amount of other sales in order to match the previous year.

Conclusion

With its luxury beachfront resort setting and presenting (arguably) the strongest vacation rental properties on Maui, Honua Kai has been the beneficiary of continued interest. For owners, with high season coming up it presents a good time to consider introducing new units to the market as some micro-markets (i.e. studios, Kamehameha 3 bedroom villa) lacking inventory. The market continues to evolve in response to developer inventory dwindling, market conditions changing, financing becoming more prevalent and a plethora of other factors. For those interested in the discussing the Honua Kai real estate market, contact us below or call 808.385.5034

Specializing in Makena and Wailea real estate, Alex Cortez is fully dedicated to representing his clients ethically and diligently. Contact him at 808.385.5034 or Alex@MauiRealEstateSearch.com for more information.